28+ ratio of income to mortgage

Web The 2836 is based on two calculations. For example if you owe 20000 the calculation would be 20000 x 5.

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

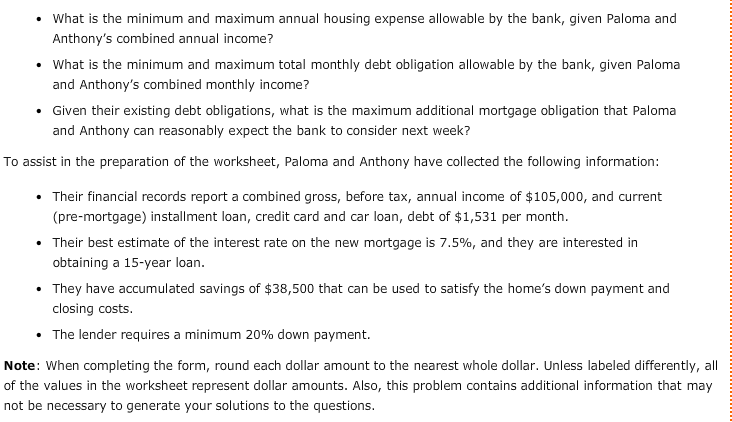

What Is The 28 36 Rule Of Thumb For Mortgages

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

. This divides your total housing expenses by your gross monthly income. Dollar amount of monthly debt you owe divided by dollar amount of your gross monthly income. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Web shorts Want to get pre-approved for a mortgage. Web Typically lenders cap the mortgage at 28 percent of your monthly income. Web The amount of money you spend upfront to purchase a home.

Web Your front-end ratio. Web Lenders want a debt-to-income ratio that is less than 36 and one where no more than 28 of that debt is used to pay a mortgage or rent. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. For example if you. Payment history makes up 35 of your credit score.

Most home loans require a down payment of at least 3. Ad Check Todays Mortgage Rates at Top-Rated Lenders. A front-end and back-end ratio.

See how much house you can afford. However many lenders let borrowers exceed 30. Web Lenders use something called the 2836 rule to determine how much you can afford in monthly housing payments which in turn determines the maximum loan amount you.

Web To determine your debt-to-income calculate. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Ad Easier Qualification And Low Rates With Government Backed Security.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Pay down your balances to improve.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Steps you can take to raise your score include. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Calculate Your Payment with 0 Down.

Its not just about your credit score. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Pay your bills on time.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The threshold calculation is 5 of the outstanding loan balance divided by 12 months. Principal interest taxes and insurance.

For example if your mortgage payment home insurance and property. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Lenders prefer you spend 28 or less of your gross monthly.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. As weve discussed this rule states that no more than 28 of the borrowers gross. Compare Apply Directly Online.

A 20 down payment is ideal to lower your monthly. Veterans Use This Powerful VA Loan Benefit For Your Next Home. For So with 6000 in gross monthly income your maximum amount.

Your debt-to-income ratio DTI is a key factor that lenders. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. The maximum DTI varies.

Web The 2836 rule is a good benchmark.

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

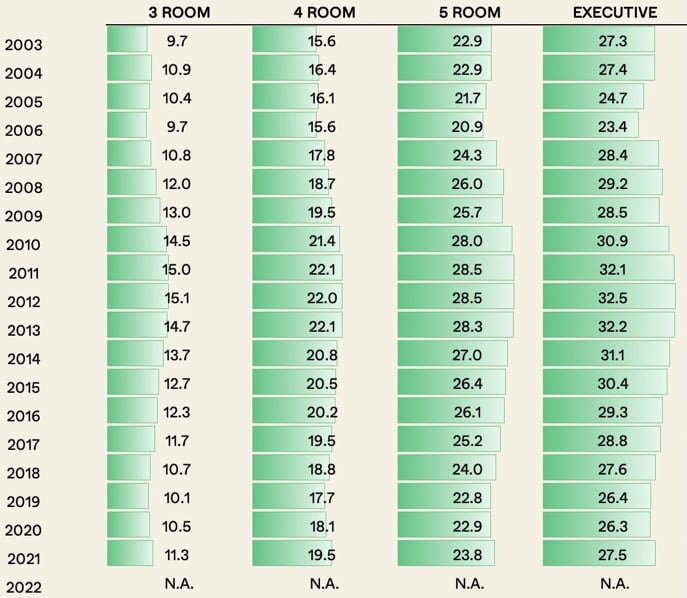

Are Hdb Flats Really As Unaffordable As Everyone Claims We Look At 468 600 Transactions To Find Out Property Blog Singapore Stacked Homes

What Is The 28 36 Rule Of Debt Ratio Budgeting Money The Nest

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

So What S A Good Ratio For Mortgage Debt To Income Pasadena Star News

Need A Mortgage Keep Debt Levels In Check The New York Times

What Percentage Of Your Income Should Go To Mortgage Chase

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What Is The Calculation Of A Home Loan Or Emis Quora

Debt To Income Ratios Home Tips For Women

What Is The 28 36 Rule Of Debt Ratio Budgeting Money The Nest

What Percentage Of Your Income Should Go To Mortgage Chase

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

Calameo Wallstreetjournaleurope 20170811 The Wall Street Journal Europe

How Much House Can You Afford The 28 36 Rule Will Help You Decide

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Solved First Filling The Blank A Back End B Front End Chegg Com